Weekly Update

EOG bolts on in the EF, another Waynesville behemoth, rigs begin to slide

This insight is planned as a weekly roundup of activity from the Baker Hughes Rig Report, current prices/futures, and news.

AFE Leaks updates.

The AFE Leaks API is now live — bring real-world well cost data for our now 94,000+ wells directly into your tools like Power BI or Excel.

✅ Instantly pull Actual and AFE costs

✅ Full cost breakdowns by component

✅ Well-level data: completions, casing/tubing, formations, production, locations, and more

✅ Updated regularly — ready for your internal workflows

📬 Reach out at bd@afeleaks.com to get started or discuss a license.

🔁 Not ready for a full API subscription? I also offer custom downloads — choose a specific set of wells (by operator, basin, or date range) and get a one-time export with full cost and well details. Perfect for analysts doing one-off evaluations, bid decks, or internal benchmarking.

Sample Power BI to showcase the API and capabilities is out. Link is here.

Colorado and Ohio were added to the dataset this week. Look for Wyoming (next), Utah, and North Dakota data to be added in the coming weeks.

Continue to grab as many recent AFE’s as I can to try and quantify changes due to tariffs; not seeing much yet but there is often a lag on impact due to procuring material prior to drilling (like pipe).

Taking a look at EOG’s Utica wells for next insight for paid subscribers, given we have quite good coverage of historical AFE costs for them. As an added bonus, they give out estimated EUR’s, so it’ll be fun to see how that’s turned out versus expectations.

Activity Update

Earnings are out in force this week.

Organic growth stalwart, EOG, bucked that trend and announced a ~30k acre bolt-on in Atascosa of the Eagle Ford. Using the power of my eyeballs, this appears to be Arrow S acreage. I don’t know too much about them, but they operate the wells in the blanks space between previous acreage and current. Not sure why it hasn’t had too much development to date, but in the Eagle Ford, that usually means poor economics or lease issues. Not much else of note except for trying to convince us that their well costs will eventually trend to zero. There was some discussion on reducing costs in the Utica; the most recent AFE data from March pegs it at $9.1 million for a 16,000 ft lateral, which is slightly less than their reported average.

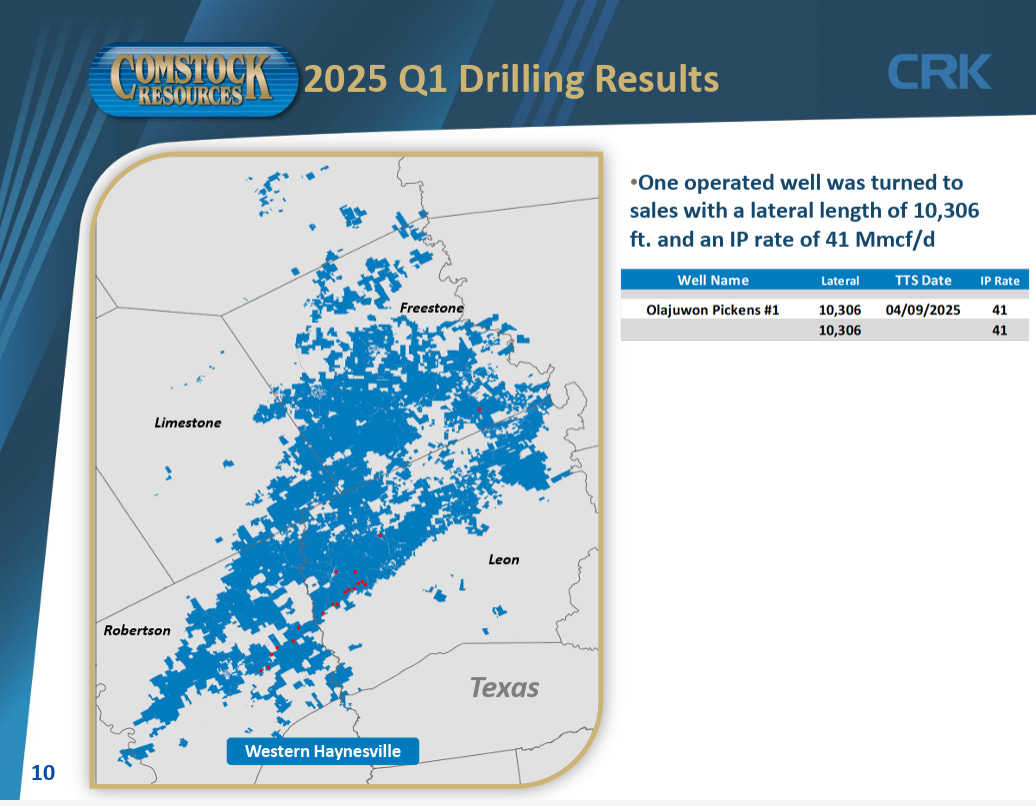

Comstock reported a new Waynesville completion to the north of their historical development in Freestone county. They report a 41 Mmcf/d IP from a 10,306 ft lateral. This is one of the deeper ones, at around 17,300 ft TVD. The others that deep came in between $33-$57 million, so we’ll see how this one goes! They’re also pushing the Horseshoe dream, so we’ll keep tabs on how that progresses. For something as heavily developed as the Haynesville, it probably does have some applications for stranded 640’s.

CVX and XOM both reported lower profits, as lower prices and refining margins ate into the results. With even lower prices next Q, expect another down one.

SM beat on production but also reported higher capex, as they had the foresight to secure some pipe before tariffs rolled through (at least that’s what they say). Non-op capex came in higher as well. The production beat was attributed to better than expected waxy crude production out of the Uinta. Also Rystad gave them some sustainability score, as if anyone cares.

Pricing

Prices have continued their steady down-trend, now below $60 WTI, after Reciprocal Tariff day. Almost like people think this will cause a recession and drop demand or something. Don’t fear though, B/E = WTI - $10 so keep those rigs a-runnin’. Gas folks had a good week at least, rebounding well above $3.

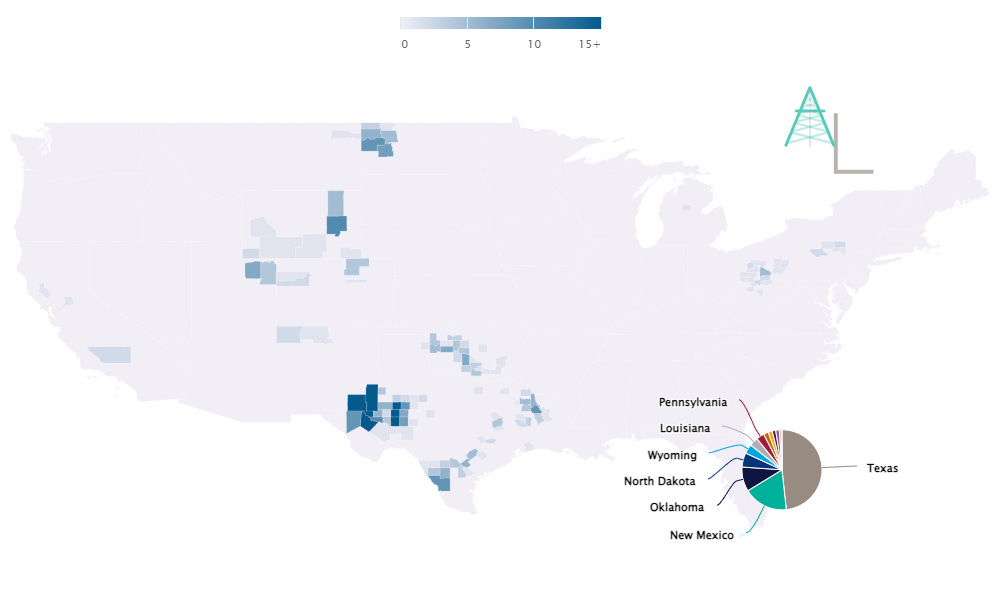

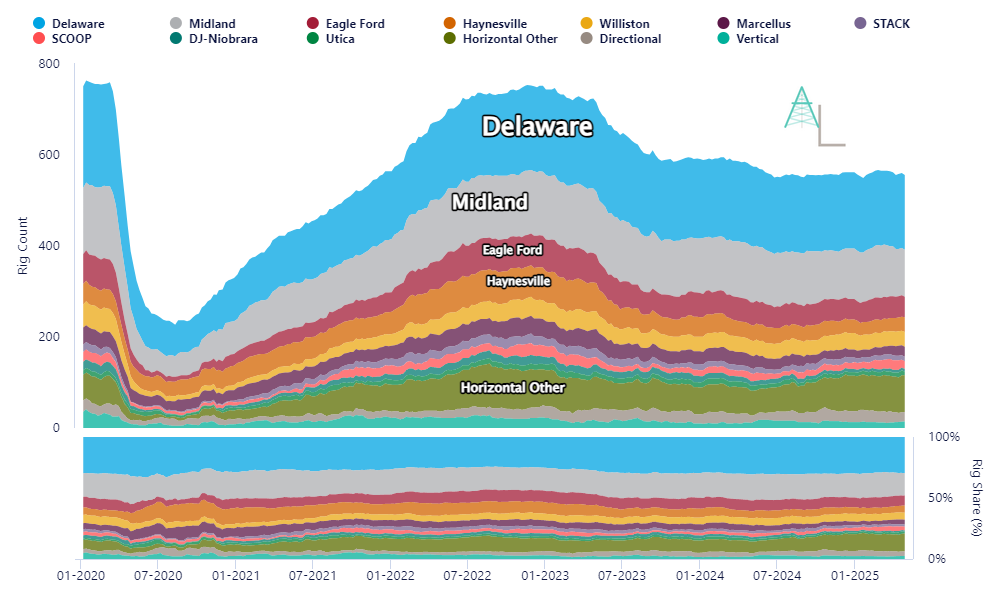

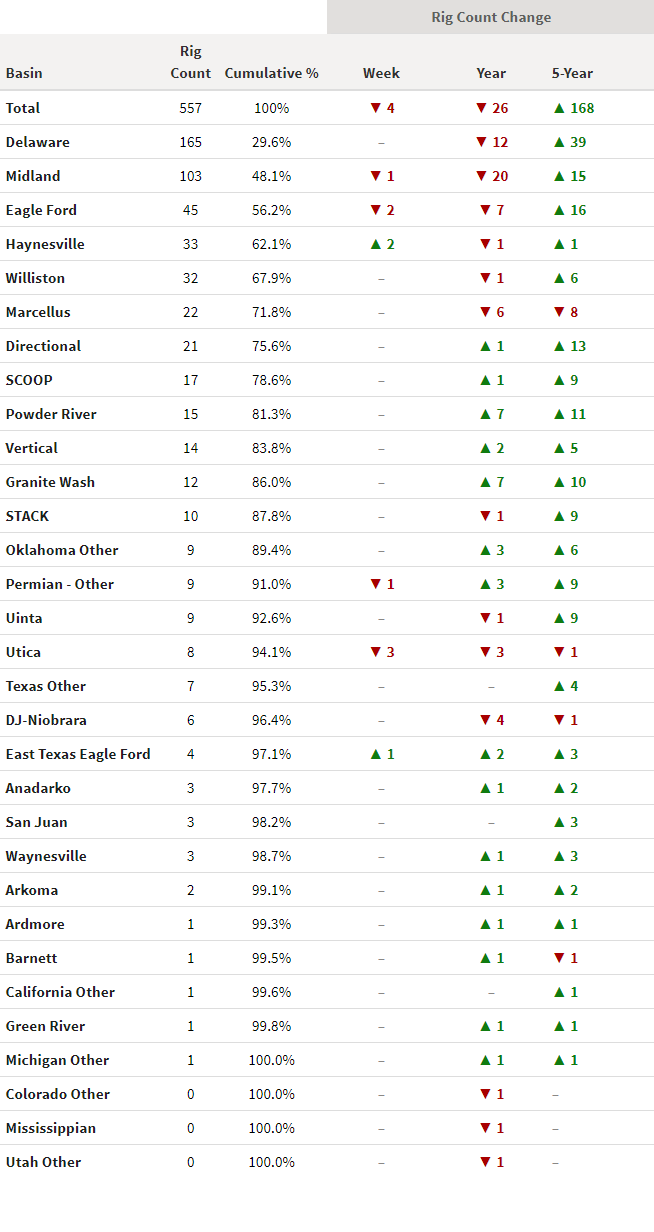

Rigs

Finally saw rigs start to drop, with Midland continuing it’s decline and the Eagle Ford and Utica seeing drops as well. Someone decided to pull the trigger on Haynesville drilling this week though.

And that’s all. Omitting the well stuff as I have some travelling to do but will get back to it next week. Expect the EOG writeup to come out early next week.