AFE Leaks updates.

The AFE Leaks API is now live — bring real-world well cost data for our now 96,000+ wells directly into your tools like Power BI or Excel.

✅ Instantly pull Actual and AFE costs

✅ Full cost breakdowns by component

✅ Well-level data: completions, casing/tubing, formations, production, locations, and more

✅ Updated regularly — ready for your internal workflows

📬 Reach out at bd@afeleaks.com to get started or discuss a license.

🔁 Not ready for a full API subscription? I also offer custom downloads — choose a specific set of wells (by operator, basin, or date range) and get a one-time export with full cost and well details. Perfect for analysts doing one-off evaluations, bid decks, or internal benchmarking.

The original app, which took me a good amount of time to develop, is dead. RIP. But good news, I’ve moved all of that functionality to a new and better format, with not-so-finicky authentication. Though cookies means that occasionally you will need to log out and re-login to access either research or the apps.

Benchmarking, for high-level trend analysis, available for users at Basic/Premium/API users.

Benchmarking +, for trend analysis, expanded data investigation, and our AI chat tool, available for users at Premium and API users.

Well Explorer, for deep dive analysis into individual wells, and our AI chat tool, available for users at Premium and API users.

As mentioned above, we’ve build an AI Chatbot for Premium and API users that will query our database and answer questions, basically another layer to search for target wells, or to spit out some high-level or detailed analysis. With any chatbot, be clear and explain as clearly as possible, or you may not get the result you want, but it can do some very cool things with tests so far. As some background, you have to give very specific instructions in the back-end to make this work, so will continue refining this as time goes by.

Sample Power BI to showcase the API and capabilities is out. Link is here.

Basic requirements for any potential API client is to test out the API beforehand. Who knew?!? Anyway, added functionality to test the API by using a subset of the data. Reach out to me at bd@afeleaks.com to request a trial.

Spent most of the last two weeks revising some of the app functionality, finding new well cost sources, and working on additional datasets that may be added soon (revenue/marketing data in Texas and financial data).

I’ll be looking to add some more commentary on the EOG acquisition of Encino, but feel like I’ve put out a lot of EOG-focused content lately so we’ll see.

In case you missed it, I was on the Energy Bytes podcast to talk about what I’m trying to achieve here, as well as discuss the data market as I see it.

Began adding Wyoming wells into the database.

Will kick off monthly well data update this week.

I will be in New York the next week and a half, so if you’d like to meet shoot me a note.

Activity Update

EOG dusted off the M&A binders and picked up Encino’s 675k net acres for ~5.6B. This expands their Utica acreage towards the more gassy (and better) acreage to the east, though it is more heavily developed than their position. We talked about EOG’s current position in a recent insight, which was heavily weighted towards the poorer dead oil window.

Rigs

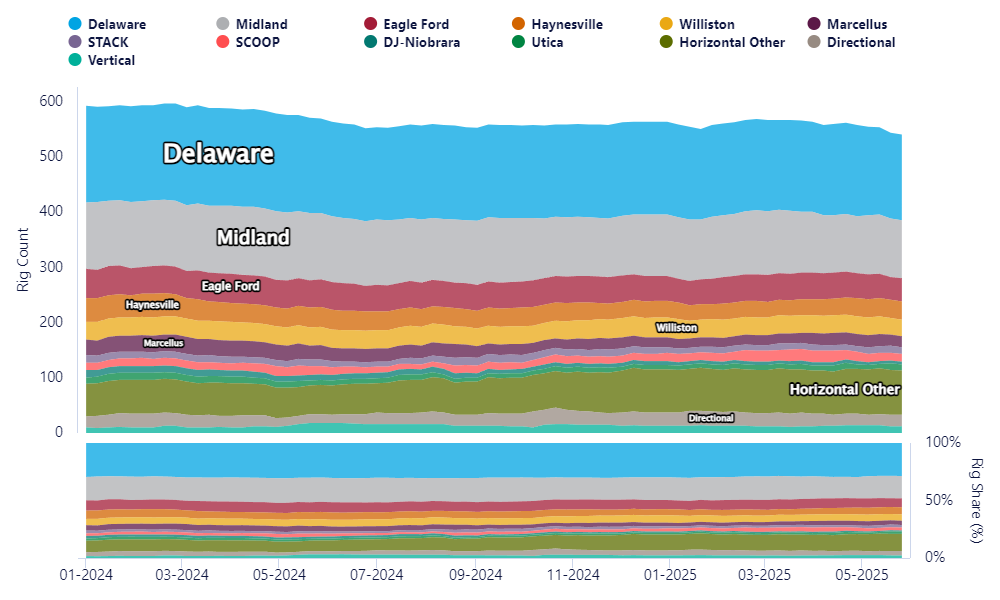

US rigs are now down 14 in the last month. The majority of the loss is out in the Delaware, with 10 lost in the last 4 weeks. Gas-play rigs are up slightly in that period.