I’m out in New York for the week trying to convince them to love Oil & Gas (just kidding; that’s an impossible task). In reality, just here visiting friends and being irrationally angry at how green everything looks and the nice weather. Alas, life as a startup means no real time off, so let’s update on what I’ve been doing while squinting at a small laptop screen.

Total well count is somewhere around 97,000 right now; really hoping to get into the 100k range over the next couple of weeks.

Began adding an upload date to the main cost table so that users on the API can tell when new data gets uploaded. As it stands, almost everything has an upload data of 6/5, except for….

A few hundred new Oklahoma AFE’s. Tracked down a good source for full AFE’s as opposed to the obscure DHC/Completed well cost from pooling orders, so I’ll be transitioning those wells to full cost breakdowns over the next few weeks (right now I’m just pulling in the total cost and the source AFE pdf so that users on Premium+ can view them). I’m unsure of the total well count for these, but guesstimating visually I’d say there are about 1000 AFE’s here from the 2021-2025 timeframe. I believe I’ll be access older wells also, but haven’t gone through the process yet.

I do have some AFE’s in North Dakota, but it’s not a large dataset. I do have a good number of wells with a capex estimate from AMD’s in the state, so at the very least I’m going to begin pulling those wells in so that I have a datapoint for them and add that state to our coverage list. I’ve got some potential other sources I’m vetting for the full AFE cost breakdown.

I’m currently vetting a potential AFE source in Pennsylvania; will review over the next week to see how reliable it is.

Working on some other datasets that would be available to API clients.

API is live and there is a trial option available with a subset of the data. If you’re interested in direct access to my full datasets to do with as you wish, just shoot me a note at bd@afeleaks.com.

News

Viper (NASDAQ:VNOM) and Sitio (NYSE:STR) are combining in an all-equity transaction valued at ~4.1 Bn, creating the largest publicly traded mineral and royalty company in the U.S. The deal brings together Viper’s mostly-Diamondback-operated Permian exposure with Sitio’s more diversified portfolio across key shale basins (though still heavily Permian) . Expect some cost (ie G&A) synergies to be the first big benefit, while the added scale to other basins means that Viper has a platform to begin expanding outside of Permian.

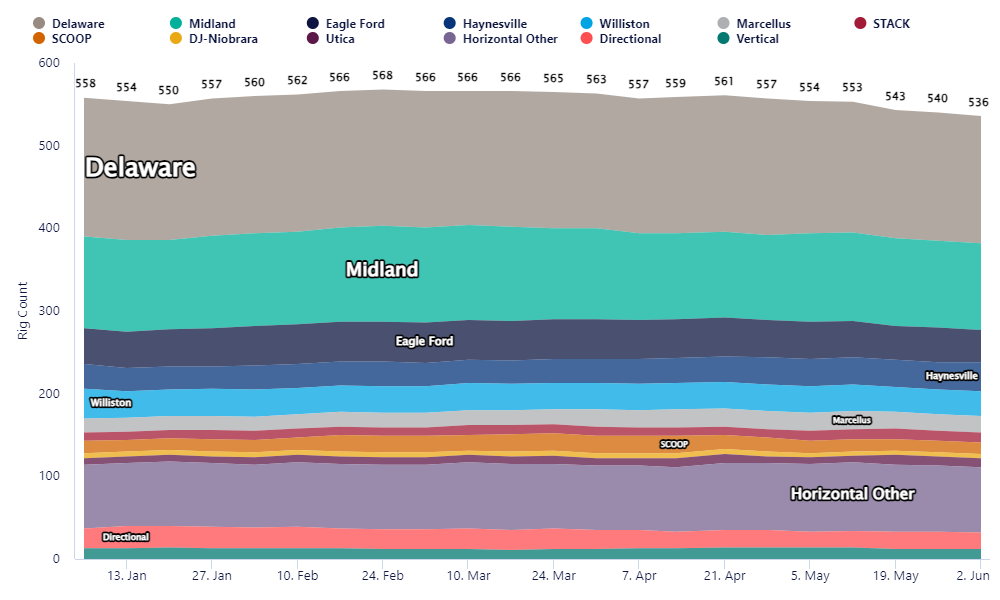

Rigs are turning over hard now, with total down by about 30 since late February.

Those drops are in the oil basins, with Delaware and Midland both losing 11 rigs. Gas plays have shown strength in that time. Granite Wash/Anadarko is likely strength in the WAB.

Paid subscribers can access my interactive research over at my premium page. Just make sure you create a new account for the site using the email you use for substack from that page. Because of how cookies work, you may have to logout and re-login to get things to work. Similarly for the apps (Basic subscribers can access the basic trend app, while Premium/API subscribers get access to the full suite of tools).

Have a great weekend.