Trumpflation: Where Are the Tariff Cost Spikes?

An early look at how Trump’s steel tariffs did — or didn’t — reshape well costs for Mewbourne

Interactive Version for Paid Subs is Here

Background

In 2025, under the Trump administration’s return to office, tariffs on steel and aluminum imports were significantly increased from previous levels—rising sharply from 25% to 50% for both steel and aluminum1. Given the historical precedents, the upstream oil and gas is understandably concerned, anticipating substantial impacts on costs due to the sector’s heavy reliance on imported steel for casing, tubing, and critical drilling and completion equipment.

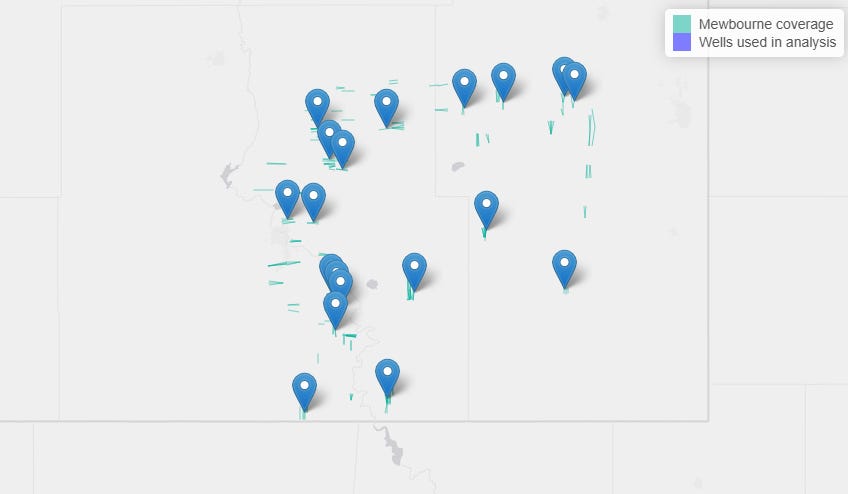

However, an initial review of the Authorization for Expenditure (AFE) data from Mewbourne in response to the increased 2025 tariffs suggests impacts have, so far, been surprisingly muted compared to industry expectations. If anything, costs are lower than what they were a year ago. Still, it is early, so much of the impact may not have been felt yet.

In this note, we will examine what, if any, impacts steel inflation have had on casing assumptions in Mewbourne AFE’s, as well as look at some historical trends in rig rates and stimulation costs.

AFE Leaks provides actual or AFE-level cost data for over 98,000 wells across major U.S. shale plays, including detailed cost breakdowns for Premium/API users. Texas lease-level product revenues—broken out by oil, gas, and NGLs (where processing occurs)—are also available to support economic benchmarking. For Mewbourne in New Mexico, we currently sit at 216 historical AFE’s, though more are added weekly.

Keep reading with a 7-day free trial

Subscribe to AFE Leaks to keep reading this post and get 7 days of free access to the full post archives.