Deeper Returns: Evaluating the Delaware Woodford’s Emerging Economics.

Tracking Progress in the Delaware Basin Woodford

Interactive Version found here for paid subs. If you get an unauthorized token, it means your cookies have expired, so just logout and re-login.

As operators explore deeper horizons in the Delaware Basin, the Woodford Formation is showing some promise as a viable, liquids-advantaged target—particularly in areas where overpressure, maturity, and favorable rock mechanics align. Though limited in exposure compared to the Wolfcamp or Bone Spring, Woodford development benefits from existing infrastructure and offers meaningful upside for operators pursuing additional inventory. In this analysis, AFE Leaks brings together product-level revenue data, well/production profiles, and drilling and completion cost splits to look into early-stage project economics and see if this target offers meaningful upside.

AFE Leaks provides actual or AFE-level cost data for over 97,000 wells across major U.S. shale plays, including detailed cost breakdowns for Premium/API users. Texas lease-level product revenues—broken out by oil, gas, and NGLs (where processing occurs)—are also available to support economic benchmarking.

Geologic Overview: The Woodford in the Delaware Basin

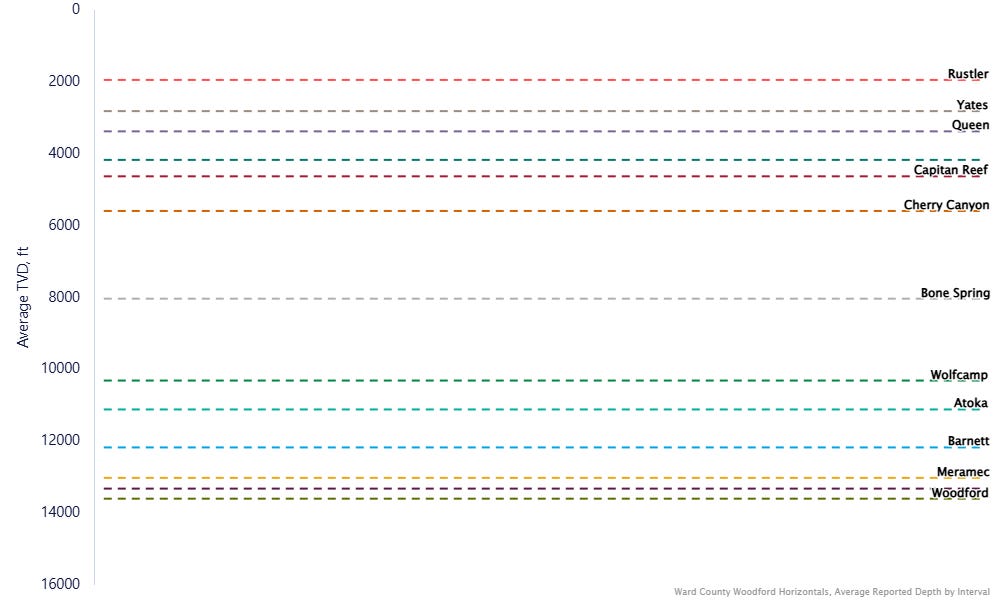

The Woodford Formation, a Late Devonian-Early Mississippian black shale, has long been recognized as a key source rock across the greater Permian Basin. In recent years, horizontal development in the Delaware Basin has extended deeper to evaluate the Woodford not just as a source but as a viable unconventional reservoir. Although less laterally extensive and more geologically complex than overlying Wolfcamp and Bone Spring targets, the Woodford offers distinct value through its thermal maturity, organic richness, and overpressure, making it an emerging zone of interest.

Keep reading with a 7-day free trial

Subscribe to AFE Leaks to keep reading this post and get 7 days of free access to the full post archives.